Whenever I cruise with certain cruise lines, I get up to $250 to spend onboard. And it’s not because of this website or my emails with the best cruise deals. It’s because I’m a shareholder.

In this guide, I’ll explain what it means to be a cruise shareholder, what the perks are of holding stocks and shares in cruise lines, and where you can buy your own shares if you want to.

Why Buy Cruise Stock?

Buying cruise stock can be a good way to invest your money if you believe that the cruise line’s value will grow, but it also gives you perks when you cruise with that company.

Those cruise perks are usually free onboard credit to enjoy with your cruise. You can claim this perk every time you cruise; it’s not a one-off benefit.

Depending on which shares you buy, you might be able to enjoy those perks across several different cruise lines.

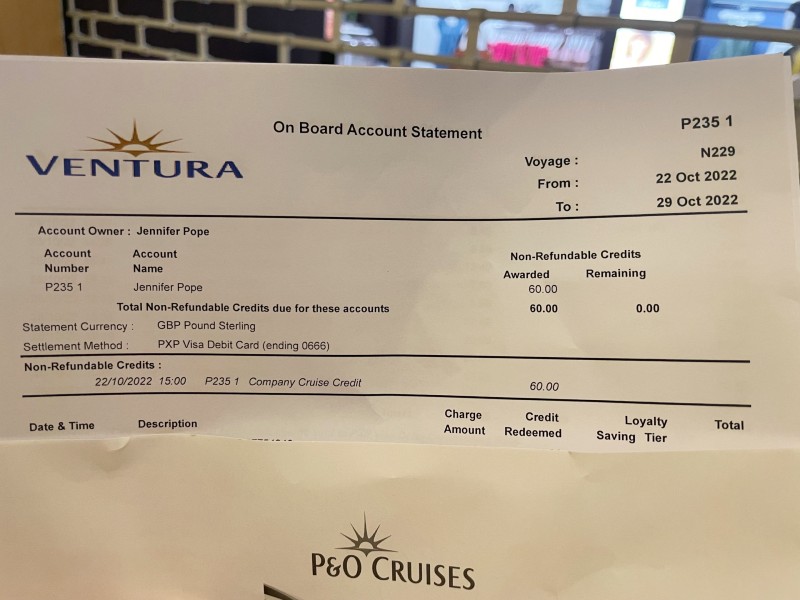

So, you can quickly earn back the cost of your share investment just by cruising multiple times. I’ve invested in Carnival shares, and I’ve already earned back the amount I paid for the shares in on-board spend with my cruises with P&O Cruises.

It didn’t take long, and I still have the shares too.

While investing in cruise shares could be a way of earning money, if the cruise line was to grow in value, you have to remember that the value could drop too – but you will at least get that onboard credit amount every time you sail.

Do You Get a Discount On a Cruise If You Own Stock?

You won’t get a discount on a cruise if you own stock in the company – you do still have to pay full price. However, you will technically get a discount on the total cost of your cruise, since you’ll earn free onboard spend to put towards your drinks, your speciality dining or other parts of your cruise on the ship.

Cruise Lines That Offer Cruise Stock Perks

Let’s take a look at each cruise company that offers stock perks, how much you can get on each sailing, and which cruise lines it covers.

1. Royal Caribbean Group (RCL)

If you own at least 100 shares in the Royal Caribbean Group, you can enjoy shareholder perks of onboard credit every time you sail.

- $50 onboard credit for sailings of 5 nights or less

- $100 onboard credit for sailings of 6-13 nights

- $250 onboard credit for sailings of 14 nights or more

- $1,000 onboard credit for world cruises

Royal Caribbean Group shares give you onboard credit with:

- Royal Caribbean International

- Celebrity Cruises

- Silversea Cruises

There are a couple of exceptions – you won’t get the credit if the ship is chartered, and it doesn’t apply on cruises to the Galapagos Islands.

As a guideline only, the Royal Caribbean Group’s share price between October and December 2023 had a low price of $81.87 and a high of $129.97, so you would’ve paid between $8,187 and $12,997 to acquire the 100 shares necessary to qualify.

The price will have changed so check the latest share price when you are purchasing.

Read more about the Royal Caribbean shareholder benefits:

2. Carnival Corporation (CCL or CUK)

If you own at least 100 shares in Carnival Corporation & PLC, you can enjoy shareholder perks every time you sail.

Exactly how much you get depends on the brand you’re sailing with, and where you are cruising, as the ships have different onboard currencies.

- $50 / €40 / £30 for sailings of 6 nights or less

- $100 / €75 / £60 for sailings of 7-13 nights

- $250/ €200 / £150 for sailings of 14 nights or more

Carnival Corporation shares give you onboard credit with:

- Carnival Cruise Line

- Princess Cruises

- P&O Cruises

- P&O Australia

- Holland America Line

- Seabourn

- Cunard

- Costa Cruises

- AIDA Cruises

As a guideline only, the Carnival Corporation & PLC’s share price between October and December 2023 had a low price of $11.08 and a high of $19.22, so you would’ve paid between $1,108 and $1,922 to acquire the 100 shares necessary to qualify.

The price will have changed so check the latest share price when you are purchasing.

Note that Carnival has two stocks – CCL and CUK. CCL is under the New York Stock Exchange and CUK is under the London Stock Exchange. You can buy either and receive the exact same on-board credit. The Motley Fool advises that you should buy the cheapest one.

Read more about the Carnival Corporation & PLC shareholder benefits:

- Carnival Shareholder Benefits

- P&O Cruises Shareholder Benefits

- Cunard Shareholder Benefits

- Holland America Line Shareholder Benefits

- Princess Cruise Shareholder Benefits

3. Norwegian Cruise Line Holdings (NCLH)

Norwegian Cruise Line Holdings has the same offer – as long as you own 100 shares in the company, you’ll enjoy onboard spending on any cruise line under that umbrella.

- $50 onboard credit for sailings of 6 nights or less

- $100 onboard credit for sailings of 7-13 nights

- $250 onboard credit for sailings of 14 nights or more

NCL shares give you onboard credit with:

- Norwegian Cruise Line

- Oceania Cruises

- Regent Seven Seas Cruises

As a guideline only, the Norwegian Cruise Line Holdings share price between October and December 2023 had a low price of $12.76 and a high of $20.95, so you would’ve paid between $1,276 and $2,095 to acquire the 100 shares necessary to qualify.

The price will have changed so check the latest price when you are purchasing.

Read more: NCL Shareholder Benefits Explained

Where to Buy Cruise Stock

To buy stock in a cruise line, you’ll typically need to use a stockbroker. These can either be a human, who can talk to you about your options, or it can just be an online platform.

There will be fees involved with either approach, but using an online platform tends to be cheaper.

I can’t tell you which is the best option, because I haven’t used them all. But I used a platform called eToro to buy my shares in Carnival and I had no problems.

(eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

I chose it because it’s one of the most popular platforms – it has over 20 million registered users – and the reviews are mainly very positive. There are low fees for buying shares, too. Overall, I was really happy with the experience.

- Buy Royal Caribbean Group shares with eToro

- Buy Carnival Corporation & PLC shares with eToro

- Buy Norwegian Cruise Line Holdings shares with eToro

Claiming Cruise Stock Perks

How you actually claim your perks varies depending on your cruise line, but it’s usually pretty easy.

Claiming Royal Caribbean Group Shareholder Perks

You can claim your free onboard credit using a simple online platform. Make sure you have details of your shares and your cruise booking to hand, and fill in the form three weeks before your cruise, or earlier.

Claiming Carnival Shareholder Perks

To claim your shareholder perks on a cruise line owned by Carnival, you’ll need to download an app called Stockperks – it’s available on Android and iOS.

Follow the instructions on the app to claim your onboard credit. Make sure you put your claim in at least four weeks before your cruise. You can’t do it too soon though. I tried to submit mine 5 months before and I got this message…

Claiming Norwegian Cruise Line Holdings Shareholder Perks

To claim your onboard credit with an NCLH cruise line, you’ll need to download this form and then email it to one of the following addresses:

Make sure you get your request in at least 15 days before you sail – though I’d suggest putting the claim in sooner than that.

Disclaimer

I’ve mentioned this briefly already, but for absolute clarity, nothing in this guide constitutes financial advice. I’m not a qualified financial advisor. If you decide to buy shares in any of the cruise lines in this guide, you should be prepared for the fact that you could lose your investment.

Hopefully, you won’t, but I have to state that. Investing in Carnival was my own personal choice and I know that there’s a chance I could lose that money, although like I say, I’ve already earned back the value in onboard credit anyway.

Final Word

Investing in cruise line shares isn’t for everybody – not everyone has the funds available to buy 100 shares in their preferred cruise line, and there’s a risk involved when you do.

But if you decide that you want to, it’s good to know about these perks you can enjoy, and how to claim them. It’s great that you get them on every cruise too, so if you do sail with one cruise line regularly, you can enjoy a lot of free onboard credit while you’re a shareholder. Enjoy it!

Related Posts:

- How To Get A Free Cruise (15 Ways To Do It)

- How to Text on a Cruise Ship for Free

- Carnival Cruise Suite Perks

Jenni Fielding is the founder of Cruise Mummy. She has worked in the cruise industry since 2015 and has taken over 30 cruises. Now, she helps over 1 million people per month to plan their perfect cruise holidays.

👌

Would like about buying shares on Cunard’s cruise

Wow, this is very thorough and I had no idea!