Carnival Corporation & PLC is one of the biggest cruise companies in the world, in terms of the number of brands (and therefore ships) that it operates. It’s a huge organisation, and owning shares in it means that you have a stake in some of the biggest cruise brands on the ocean, including Carnival itself, Princess Cruises, Seabourn and more.

There are also Carnival stockholder benefits available to anyone who owns 100 shares or more – and they apply to every cruise you take with a cruise line under the Carnival Corporation umbrella.

Let’s take a look at what the Carnival stock ownership benefits are, which cruise lines they apply to, and how you go about claiming the benefit.

What Are The Benefits Of Holding Carnival Cruise Shares?

Anyone who owns 100 shares or more of the Carnival Corporation can enjoy an amount of onboard credit on their next cruise, up to $250 on sailings on cruise lines operating out of the US.

The amount of on-board credit you get depends on the length of your sailing, but for cruises on a Carnival ship, you will get:

- $250 of onboard credit to spend per stateroom on cruises of 14 days or longer

- $100 of onboard credit to spend per stateroom on cruises of 7 to 13 days

- $50 of onboard credit to spend per stateroom on cruises of 6 days or fewer

And the good news is that this isn’t a one-time benefit. It is available for every cruise you book on a Carnival ship, or on any ship belonging to a cruise line under the Carnival Corporation, as long as you hold 100 shares of CCL stock or more.

If you decide to cash in your shares, that does mean you lose the benefit entitlement.

The Carnival cruise stock benefits vary a little depending on which cruise line you’re sailing with. Those figures above are what you get when you sail on any of the cruise lines operating with US dollars as their onboard currency.

Cruise lines you can use your Carnival shareholder benefit with:

- Carnival

- Holland America Line

- Princess Cruises

- P&O Cruises (UK & Australia)

- Seabourn

- Aida Cruises

- Selected Cunard sailings

- Selected Costa sailings

You do still get the benefit if you’re cruising with a cruise line operating with a different currency, it’s just that the values are tweaked to match.

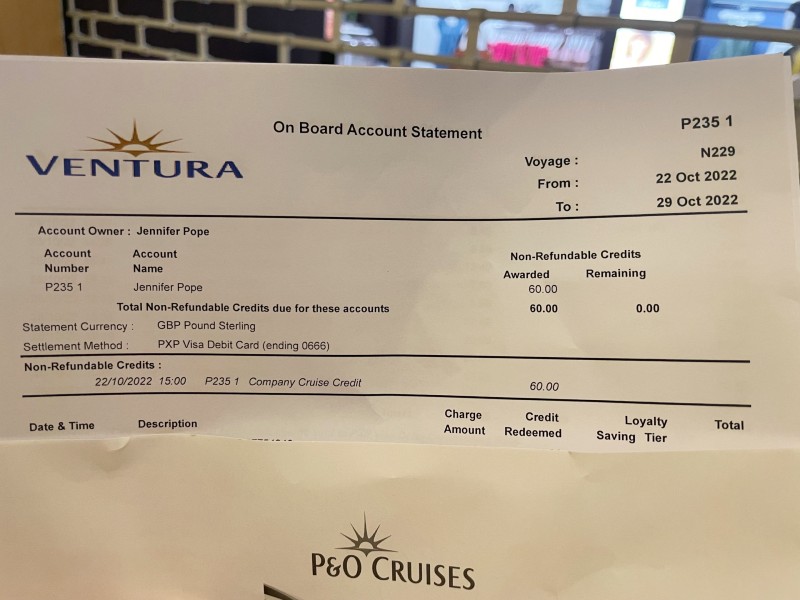

For example, here’s the On Board Account Statement from my recent cruise with P&O Cruises that shows that I received £60 of company cruise credit, thanks to owning shares in Carnival.

For sailings on P&O Cruises Australia, or Princess sailings in Australia, the figures are the same but in Australian dollars – $250, $100 and $50.

For cruises in Europe on-board a Costa ship or AIDA ship that are using Euros as their currency, the on-board values are €200, €75 and €40.

And finally, for sailings out of the UK on a P&O Cruises, Cunard or Princess Cruises ship, the values are £150, £60 and £30.

| Cruise Line | 14+ Days | 7-13 Days | Up to 6 Days |

|---|---|---|---|

| Carnival | $250 | $100 | $50 |

| Other US Sailing | $250 | $100 | $50 |

| Australian Cruise Line | $250 | $100 | $50 |

| European Cruise Line | €200 | €75 | €40 |

| UK Cruise Line | £150 | £60 | £30 |

Since I mentioned the benefits of buying Carnival shares in my weekly email, I’ve had lots of people email me to say that they’ve also bought shares and are happy to receive the free onboard credit. Like this one…

“We took your advice and bought 100 Carnival shares which cost £550. Two Cunard trips gave us £250 each extra onboard spend and another gave us $200 (£175) total £675, also the shares have gone up £175. Best investment I’ve ever made, thankyou, keep up the good work.”

Robert and Veronica Dennehy

How To Buy Carnival Shares

To buy shares in any company, you’ll typically need to use a stockbroker. This can be either a human being or an online platform. There are various fees involved with this, but an online platform is usually the cheapest and easiest way.

I can’t advise you which is the best, but I personally chose to buy my Carnival shares through an investing platform called etoro. I chose this one because it is one of the most popular platforms with 20 million registered users and has great reviews and low fees.

I’ve been very happy with my share-buying experience and found it really easy to do.

(eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

Read more: Should You Invest In Carnival Corp?

How To Claim Carnival Shareholder Benefits

Unfortunately, the Carnival stock benefits are not applied to your cruise automatically. They’re handled by a separate team and need to be manually applied to your account every time you sail.

This means if you want to take advantage of the free onboard credit, you need to ask for it every time you have a cruise booked. You need to make sure to make your claim at least four weeks before your sailing date.

The information you need to provide includes:

- Your legal name

- Your booking number

- Your ship and sailing date

- Proof of your stock ownership

Important – Whereas the Carnival brands used to let you claim the credit via fax and then later email, now it’s all handled via an app called Stockperks.

You’ll need to download the app to your smartphone, then verify the stock you own by taking a photo of the key details.

Here’s a video showing you the Stockperks app works:

As long as you provide these details in time, the amount will be added to your account ready for you to enjoy on your sailing. If you miss the deadline then you won’t be able to request it, so get your application in early.

You can get all the details you need from the shareholder platform you use – so etoro for me.

Carnival Shareholder Benefit Terms

There are a few terms and conditions that you need to be aware of with the shareholder benefits for Carnival.

Firstly, as is usually the case with special offers like these, you can’t claim onboard credit as a Carnival shareholder if you’re an employee of the company. This applies across the board, so if you work for Princess Cruises, you can’t claim it on a Carnival cruise.

It’s also a benefit that applies on a per-stateroom basis. So you can’t buy 200 shares, register half with yourself and half with your partner, and then both claim the onboard credit if you’re sharing a stateroom.

But the good news for solo travellers is that you don’t need to own 200 shares if you’re cruising on a single occupancy fare – 100 is still the minimum amount.

You can use the credit for most things on board but there are some limitations. It can’t be put towards your outstanding cruise balance and you can’t use it for gratuities or at the casino. Check out this guide to find out the best way to spend your credit: 12 Ways To Use Your Carnival Onboard Credit Like a Pro

To Conclude

Buying shares is inherently a risk, and so I can’t tell you whether it’s a good idea or a bad idea to invest in Carnival stock. However, if you do decide that it’s a risk you want to take with your funds, you can enjoy a healthy amount of onboard credit with every cruise on a Carnival Corporation ship in the future.

If you book cruises every year like I do, then over time, you might even make back the cost of your investment – whilst hopefully seeing your invested money grow at the same time. Just make sure you always remember to claim your credit before every sailing.

You can check the current share price here.

Related Posts

- 12 Ways to Use Your Carnival Onboard Credit Like a Pro

- Carnival Cruise Ship Classes Compared

- Carnival Cruise Platinum Perks

Jenni Fielding is the founder of Cruise Mummy. She has worked in the cruise industry since 2015 and has taken over 30 cruises. Now, she helps over 1 million people per month to plan their perfect cruise holidays.

There seems to be a few rumblings that this years obc via shares will not go ahead after 31st July 24

Reviews on Google Play say that the Stockperks App is unsuitable for UK users as it is entirely US-centric with no options for UK addresses, currency etc. All the UK users are hoping that P&O abandon the use of the Stockperks App and go back to email.

Hi, I am a shareholder with Carnival and have booked a cruise with Holland America to Japan. How do I contact Carnival to apply for my cruise credits? Is there an email address I can use of a telephone number? Regards John

I’m curious on one thing.. if you already have OBC as it was part of the offer (which is most select or Cunard prices)do carnival then say this was an offer price so your not entitled

In my experience they stack them both together.

You get both. Shareholder benefit is in addition to any other OBC

As of 3-18-24 my next cruise was a casino offer with $500 obc cabin for the two of us and carnival said i do not meet the terms. I have not called them but sure its the OBC given already. i got my next cruise OBC without casino OBC offer. Your thoughts please

Hi Jenni, i have bought the shares via Etorro but i can’t find a away to screenshot share evidence with both my name and share details. Could you tell me what you sent which was acceptable.

Hi Gary. If you login on your computer (not the mobile app) you can see a statement of your purchases. I just downloaded that and sent it to them. I saved it so I just send the same file every time now.

Jenni

How did you prove ownership of shares to Carnival in order to request cruise credit. I can’t see anywhere on the eToro App where you can get any documentation showing your name.

It may be easier to get your account statement on the website. Log in to etoro.com then on the left click on Settings.Then click on Account and next to Account Statement click View. Then Click Account Activity. I saved this as a pdf and sent it to Carnival.

I understand the way the benefits work but can the shares be in 2 names

Jenni,

Your article from 1 May 2023 popped up when I googled “has carnival renewed their shareholder benefit”.

From what I understand, from the Carnival website, their current stock benefit must be used by 31 July 2023 and cruise must have been booked by 28 February 2023.

Have you heard anything about this situation?

Hi Allen. I think you may have an old page there. This is the current document which shows that it’s applicable on sailings up to July 31 2024: https://www.carnivalcorp.com/static-files/bc1b7f04-a3e8-4176-91ac-a529290fe45d It also gets renewed every year so I expect that weill be extended if you’re thinking of booking in for August 2024 or beyond. I hope that’s reassuring. Jenni

Wow! Thank you! You’re the best! Every time I googled it, it kept giving me the same old document. I even called Carnival. They didn’t know. Lesson learned (Go to the carnivalcorp main website and select shareholder benefit from the menu). Thank you, again.

Also, if you are cruising on a discounted rate or on an offer of any kind, they will not honor it. They will email you “Rules” stating such and not give it to you. Luckily. I bought my shares when they dropped to $8/share, so I’ll make a little money when I sell and didn’t buy for no reason.

Is there a specific date the shares must be purchased by? Im a newbee to cruising.

Hi Linda. No, this is an ongoing offer, you can buy them whenever you like. You just need to put your claim in a month before your cruise. Jenni

Hi Jenni,

Does it matter if you buy Shares on the London stock or do you need to buy on the US stock exchange?

Thanks for all your blogs

Alan

Hi Alan. You can do either. Jenni

Jenni, can i get the shareholder benefits if my shares are held in a UK ISA (Individual Savings Account) account in my name?

Yes you can, you just need to get a document to show ownership and send it to Carnival.

What do you mean by per stateroom? We usually book the inside cabin only. Will we still get cruise credit if we have 100 shares on this cabin?

Yes. The words cabin and stateroom are used interchangeably here to mean the same thing. You’ll still get it on an inside cabin/ inside stateroom. Jenni

In answer to question from Lyn:

‘If I book a cruise with an existing on board credit, can I still claim additional shareholder stateroom onboard spend?’

Yes you can claim the additional Shareholder OBC. I have done so on the last 3 cruises with Princess & P&O, have also claimed the Veteran’s OBC without any problem other than having to register the claim in time before Cruise date.

Morning Dave do you know if the on-board credit only applies to select fare or do you get the on-board credit with the saver fare?

Thanks Chris

If I book a cruise with an existing on board credit, can I still claim additional shareholder stateroom onboard spend?

I can’t find anywhere that says that you can’t. I will test it out on my next cruise.

I’d be interested in that answer too 😃

More details about purchasing shares in the UK please

Does this apply to cruises out of Australia

Hi Jenni, How do you buy shares in the U.K please ?