Credit cards often have special deals and offers that work as a sort of loyalty scheme, letting you spend points that you’ve earned for your regular spending. And the Carnival World Mastercard is a great example.

But what does the Carnival World Mastercard give you, and is it worth replacing your everyday credit card?

The answer changed recently – and it could be even more important than ever…

Important – In June 2025, Carnival announced that the VIFP loyalty program was changing to Carnival Rewards, beginning on 1st June 2026.

This will also see a change to how the Carnival Mastercard works – FunPoints will be replaced by Carnival Rewards points.

This guide still tells you everything you need to know about FunPoints as that still applies until 31st May 2026. But, where relevant, I’ve mentioned how things will change under Carnival Rewards.

How the Carnival World Mastercard Works

The Carnival World Mastercard is a credit card, and so it works just like any other Mastercard credit card – you spend money from your credit allowance and then pay it off using your own money.

The Carnival World Mastercard is not issued by Carnival. It has to be issued by a bank, after all, and Carnival prefers to focus on fun cruising rather than banking. Instead, the card is issued by Barclays, one of the biggest banks in the world.

You can use a Carnival World Mastercard anywhere in the world that accepts Mastercard – which is most places. Mastercard is one of the most widely accepted cards around the globe – second only to Visa. You can use the Carnival World Mastercard at over 37 million merchant locations in over 210 countries and territories.

By using your Carnival World Mastercard, you’ll build up FunPoints, and these can be redeemed against purchases with Carnival (and sister cruise lines). There are other benefits too, which I’ll get into.

This changes in 2026 though. Carnival’s new Carnival Rewards loyalty program introduces Rewards Points, and you’ll earn those instead of FunPoints with the Mastercard.

It’s worth noting that the Carnival World Mastercard is only open to residents of the United States aged 18 and over. While Barclays Bank does have bases around the world, this particular credit card is for the US market only.

Applying – the Credit Score You’ll Need

The credit score you need to qualify for a Carnival World Mastercard isn’t published officially, but realistically you need a ‘Good’ credit score. A ‘Good’ score is between 670 and 739, although being in this range does not guarantee you will be accepted.

Everyone’s credit score is judged alongside their financial habits. Many people who have applied for the credit card with a score below 700 have been declined, although some have been accepted. You’re more likely to be accepted if your credit rating is ‘Very Good’ (740 to 799) or ‘Excellent’ (800 to 850).

Your credit score won’t just impact whether or not you are accepted – it will also affect your credit allowance and the APR you are assigned for your card.

Depending on your creditworthiness, you will either be assigned an APR of 19.99%, 25.99%, or 29.99%.

The Benefits of the Carnival Credit Card

Here are the benefits of taking out a Carnival World Mastercard. These are correct at the time of writing, but they may change, so be sure to consult the Carnival website for the latest T&Cs.

1. Low APR On Carnival Cruise Bookings

Using your Carnival World Mastercard when booking a cruise essentially lets you spread the cost for six months without penalty. That’s because you get a rate of 0% APR on Carnival cruise bookings for six months with the card.

It’s important to make sure you clear the balance within six months of your purchase, otherwise, your remaining balance will be charged at your regular APR – either 19.99%, 25.99% or 29.99%, depending on your credit score when you took out the card.

This is a promotional APR and therefore could be changed or withdrawn in future. But if you don’t own a credit card, and you really want a cruise (especially last minute) that you don’t have the immediate funds for, then a Carnival World Mastercard at least makes it viable. Though you should only book a cruise if you know you’ll be able to clear the balance.

2. Bonus FunPoints

When you first take out a Carnival World Mastercard, you’ll be rewarded if you spend $1,000 on the card within the first 90 days. You’ll be given 30,000 FunPoints in exchange.

That’s enough for $300 of onboard credit next time you cruise!

Again, this is a promotional offer so this may not be available in future. There will typically be some kind of offer, but exactly what it is can vary. For example, in early 2023 the offer was that you would be given 25,000 FunPoints after spending $500 within your first 90 days of owning the card. And in 2024, you got 20,000 FunPoints regardless of your initial spend!

Bear this in mind – if you want to get a free $300 towards your next Carnival cruise then it may be worth getting the card sooner rather than later, as the offer could change again.

3. Double FunPoints on Carnival Purchases

Whenever you use your Carnival World Mastercard for purchases, you’ll earn 1 FunPoint for every $1 spent. However, when making any purchase with Carnival, you’ll earn twice the reward – so 2 FunPoints for every $1 spent.

This includes making cruise bookings, but it also includes any purchases you make with the cruise line onboard the ship. So if you assign your Carnival World Mastercard to your Sail & Sign account, then every time you have a drink onboard, or you book a speciality dining meal, or you make a purchase in a retail store, you’ll earn double the points.

And even better, this offer also applies to the sister cruise brands of Carnival, under the umbrella of “World’s Leading Cruise Lines”. So any time you spend on AIDA, Costa Cruises, Cunard Line, Holland America Line, Princess Cruises, P&O Cruises Australia, P&O Cruises UK or Seabourn, you will earn double FunPoints.

It’s not yet clear if this will remain true when Carnival Rewards is introduced. All of the information released so far suggests that it’ll be a like-for-like swap but I’ll keep you updated if that changes.

4. No Annual Fee or Foreign Transaction Fees

Some credit cards will charge an annual fee for owning the card, or they will charge an additional fee every time you use the credit card at an international vendor.

The Carnival World Mastercard has neither of these fees – so you don’t need to worry about paying every year for just owning the card. And more importantly, you can use the card internationally without additional penalties.

Considering how the card is aimed at cruise passengers, this is a pretty important benefit.

5. Low Introductory APR on Balance Transfers

When you first open a Carnival World Mastercard, you can transfer the balance of any other credit cards you own to the card for a 0% introductory APR. You’re permitted to do this within 45 days of opening an account, and the 0% APR remains in place for 15 months.

After this 15-month period, any outstanding balance will be charged at your typical APR.

This isn’t a unique benefit – many credit cards offer similar benefits, often for longer periods. But if you’re interested in the cruise-related benefits and you have an existing credit card with a balance that you’re paying interest on, you could save money by opening a Carnival World Mastercard and transferring that balance over.

Also, it’s important to add that balance transfers aren’t completely free. You will need to pay either $5 or 5% of the balance transfer value – whichever is the higher amount.

How Carnival FunPoints Work

The rewards system with the Carnival World Mastercard is called FunPoints. Every time you spend using the card, you’ll earn points back.

Specifically, you’ll earn 1 FunPoint for every $1 you spend using the card. The exception is when you make any purchases with Carnival or any of its sister cruise lines, where the reward is doubled – so you get 2 FunPoints for every $1 you spend.

Whether this remains the same when the Carnival Rewards switchover happens in June 2026 isn’t yet clear but I’ll update you ASAP.

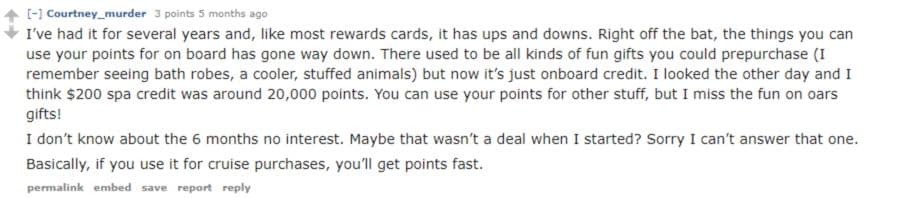

These FunPoints can then be redeemed for the following:

- Statement credit for cruise bookings and purchases with Carnival

- Statement credit for cruise bookings and purchases with sister cruise brands

- Carnival merchandise and onboard amenities

- Airline, hotel and car rental purchases

- Gift cards

At least – that’s the official line on what you can use the card for. But many people have reported that the options for merchandise and onboard amenities have essentially disappeared and are no longer available. So if you were hoping to use FunPoints towards fun little gifts for your cruise on the ship, you might be disappointed.

One other thing to note – Carnival has previously offered another benefit named “Fun Points” but this was aimed at people making group bookings. They’re not the same, so don’t get them confused if you stumble across “Group Booking Fun Points”.

What are FunPoints Worth?

Here’s a look at what FunPoints are worth for each redemption category:

| Redemption Category | Point value | Minimum redemption value |

|---|---|---|

| Carnival Cruise Purchases, Redeeming $1,500+ | 1.5 cents per 1 FunPoint | 100,000 FunPoints |

| Carnival Cruise Purchases, $50 to $1,499 | 1 cent per 1 FunPoint | 5000 FunPoints |

| Sister Cruise Line Purchases | 1 cent per 1 FunPoint | 5000 FunPoints |

| Carnival Merchandise & Onboard Amenities | 1 cent per 1 FunPoint | Varies |

| Travel Purchases | 0.9 cents per 1 FunPoint | 5000 FunPoints |

| Gift Cards | 0.75 cents per 1 FunPoint | 3,300 FunPoints ($25 Gift Card) |

How to Use Carnival FunPoints

The best way to take advantage of your Carnival FunPoints is to use them against purchases of $1,500 or more with Carnival. That way, you’ll get the most value back from your FunPoints.

As a quick example – say you book a cruise and it costs you $1,000. To redeem the full value of that cruise, you’d have to use 100,000 FunPoints.

But if your cruise costs $1,500, then it would cost the same number of FunPoints. So if you end up with 100,000 FunPoints to spend on a cruise, and your fare is around the $1,000-$1,499 mark, you might as well upgrade your room and get a bigger statement credit!

You can use FunPoints for purchases on the other brands under the World’s Leading Cruise Lines name, including AIDA, Costa Cruises, Cunard Line, Holland America Line, Princess Cruises, P&O Cruises UK and Seabourn.

However, no matter how much you’re redeeming against, it will always only be 1 cent per FunPoint.

Carnival merch, if it’s available, is the same conversion rate and the minimum number of FunPoints you have to redeem will vary.

Using Carnival FunPoints for a Free Cruise

The number of Carnival FunPoints needed for a free cruise depends on the cruise you’re booking. 1 FunPoint = 1 cent for purchases under $1,500, so a cruise costing $1,000 would need 100,000 Fun Points. However, many Carnival cruises are cheaper so would need fewer points.

At the time of writing this guide, the cheapest 3-night cruise I’ve found on the Carnival website costs $548, which is for two people and includes taxes, fees and port expenses. So this would need 54,800 FunPoints if you wanted the cruise for free.

However, you don’t need to wait until you’ve got enough FunPoints to redeem against the full value of a cruise. You can redeem as few as 5,000 FunPoints to get $50 statement credit against your cruise booking.

That’s good, since to earn those 54,800 FunPoints for that free cruise, you would need to spend $54,800 using your Carnival World Mastercard.

You could fast-track it though – you get 30,000 free FunPoints for your first $1,000 spent in 90 days, and then you could earn the other 24,800 FunPoints by spending $12,400 on Carnival purchases only, since you get double points for purchases with the cruise line.

How to Redeem Carnival Mastercard FunPoints

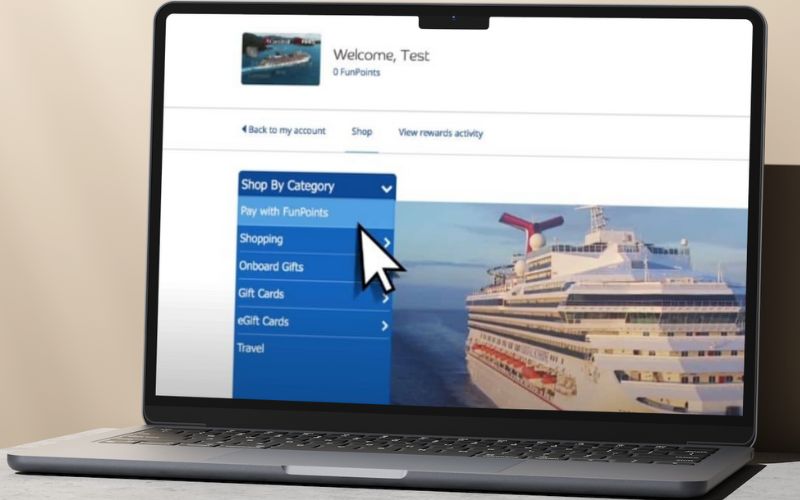

You can redeem Carnival Mastercard FunPoints by logging onto your online account with Barclays. The bank then has a menu that you can browse, in order to spend your FunPoints.

How to Redeem Carnival FunPoints for Statement Credit

To redeem Carnival FunPoints for statement credit you need to:

- Log onto your Barclays account and navigate to the FunPoints section

- Choose “Pay with FunPoints”

- A list of eligible purchases from the last 180 days will be shown

- Click “Redeem Now”

- Choose the value of FunPoints to apply

- Confirm your decision

The statement credit will be posted to your account within 1-2 business days and will show on your next statement.

To be clear, you can only claim statement credit on cruise purchases and travel purchases made within the last 180 days using your Carnival World Mastercard.

Useful Things to Know About the Carnival Mastercard

FunPoints Don’t Expire

As long as you keep your account open, your FunPoints will accumulate until you decide to spend them. If you close your account and you have enough FunPoints to redeem against a reward, you will have 60 days to do so.

When the Carnival Rewards program kicks in, in June 2026, FunPoints will be converted to Rewards Points. You won’t lose them.

Don’t Assume it Includes Travel Insurance…

Unlike many other credit cards, the Carnival World Mastercard does not include travel insurance. You will need to make sure you take out a suitable travel insurance policy elsewhere whenever you are cruising.

Using Carnival Fun Points With Other Cruise Lines

You can use Carnival FunPoints with any other cruise line owned by the Carnival Group. This includes AIDA, Costa Cruises, Cunard Line, Holland America Line, Princess Cruises, P&O Cruises UK, Seabourn, and Fathom.

Whether that still applies when Carnival Rewards comes into effect isn’t yet clear.

Is the Carnival Credit Card Worth It?

It’s tough to give an easy answer on whether the Carnival World Mastercard is worth it, because it depends on your own personal credit situation.

Many other credit card companies will offer better value rewards, and you do have to earn a lot of FunPoints in order to redeem high amounts against your Carnival purchases.

But if your typical spending habits do mean that you use a credit card regularly, and you’re a loyal Carnival cruise guest, then it’s certainly worth considering this card, provided you can keep up with repayments.

If you want to be loyal to Carnival but a credit card doesn’t feel right, there are other options too, including Carnival’s casino points (which gets you benefits such as free drinks if you spend enough in the casino during one sailing), and the VIFP program, which rewards regular cruisers with benefits such as free laundry, complimentary speciality dining, cabin upgrades and more.

You’ll also get benefits from being a Carnival shareholder.

Related Topics

- 12 Ways to Use Your Carnival Onboard Credit Like a Pro

- Carnival Cruise Suite Perks

- Carnival Cruise Platinum Perks

Jenni Fielding is the founder of Cruise Mummy. She has worked in the cruise industry since 2015 and has taken over 30 cruises. Now, she helps over 1 million people per month to plan their perfect cruise holidays.