Cruising is often a time for relaxation, but for Tony from the popular YouTube channel La Lido Loca, his recent trip on Norwegian Cruise Line’s Bliss took an expensive turn after a medical visit.

In a candid video, Tony broke down the unexpected $812 medical bill he incurred onboard and the surprising reason it could have been avoided.

A Knee Injury That Snowballed

Tony’s medical troubles began on a previous cruise aboard Holland America Line’s MS Eurodam.

While getting out of bed one morning, he heard a “popping sound” in his left knee, followed by significant pain and tightness. Despite the discomfort, Tony continued his daily activities, hoping the soreness would pass.

Fast forward to his NCL Bliss cruise – a trip where Tony was hired to create videos for the cruise line.

His knee initially seemed to improve, but during a tender ride in Cabo San Lucas, disaster struck.

As Tony described, “I took one step up… and my knee just popped again, worse than before. The pain shot up so much I thought I was going to pass out.”

Stubborn Determination

Despite the worsening pain, Tony chose not to notify NCL immediately, opting instead to push through his commitments. “I’m a super stubborn person,” Tony admitted. “I didn’t reach out to my contact at NCL because I didn’t want them to tell me not to do the work.”

After struggling to walk and realising the injury might worsen, Tony decided to seek medical attention onboard.

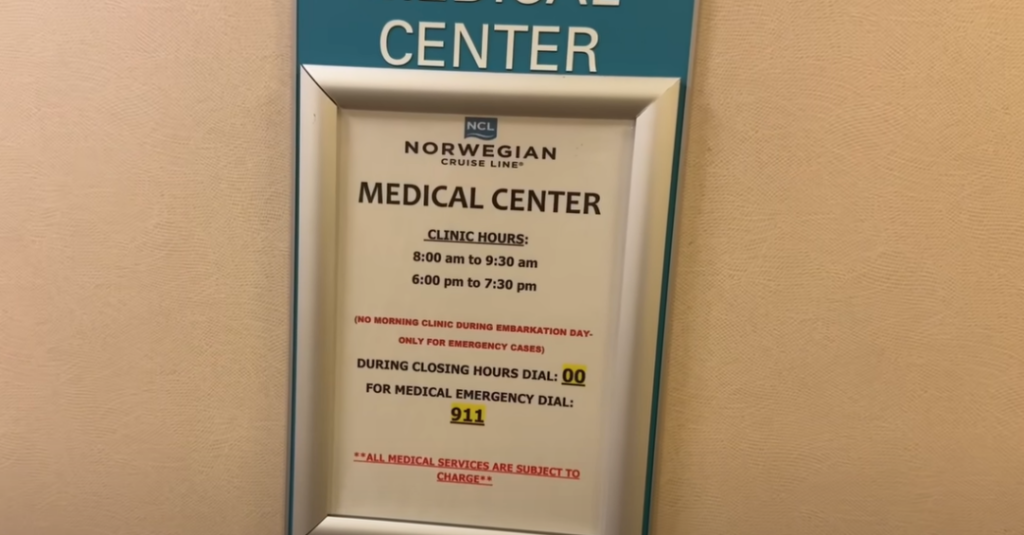

However, his initial visit to the ship’s medical center was delayed because it wasn’t an emergency, and the facility only offered non-emergency services during designated hours.

The Cost Breakdown

Once the medical center opened, Tony received a thorough evaluation, including x-rays, blood tests, and a knee brace.

Here’s how the charges stacked up:

- Professional Services: $149 for a new patient doctor visit.

- Tests and Procedures: $43 for blood extraction, $153 for laboratory tests, $153 for x-rays, and more.

- Supplies: $74 for items like a knee brace, bandages, and a catheter.

The total came to a staggering $812.

The Costly Question

One moment during the medical intake process could have potentially saved Tony the entire bill. The nurse handed him an “accident occurrence form,” asking if his injury resulted from an accident.

Initially, Tony started filling it out but realised his situation didn’t qualify as an accident.

“I wasn’t in an accident,” he explained. “My knee was already kind of jacked up… I didn’t feel comfortable claiming something that wasn’t true.”

By refusing to classify his injury as an accident, Tony missed the chance for his medical expenses to be potentially covered under the cruise line’s accident policies. Instead, he opted to pay out of pocket and rely on his travel insurance to seek reimbursement.

Lessons Learned

Tony’s story is a cautionary tale for cruisers. He emphasised the importance of travel insurance, stating, “Even if you’re going on a short cruise or a long cruise, make sure you’ve got that travel insurance, or you could be paying hundreds of dollars.”

As for how he handled the situation, Tony stands by his decision. “If it’s not an accident, I’m not going to say it’s an accident. I don’t believe in rolling like that. If you sow the seeds of dishonesty, then bad things are going to happen to you.”

What Do You Think?

Would you have filled out the accident form or paid out of pocket like Tony? Have you ever faced a medical bill while cruising? Share your thoughts in the comments below.

For more cruise insights and stories, check out Tony’s channel, La Lido Loca.

My Recommendation

My recommendation for cruise insurance depends on where you live.

- If you live the UK: Compare Your Cruise Insurance

- If you live the USA: InsureMyTrip

These are trusted price comparison sites that will quickly get you lots of quotes to match your exact needs.

Related Posts:

- Cruise Insurance Buyer’s Guide

- 13 Things Your Cruise Insurance Won’t Cover You For!

- 7 Things You Need To Know Before Buying Cruise Insurance

Jenni Fielding is the founder of Cruise Mummy. She has worked in the cruise industry since 2015 and has taken over 30 cruises. Now, she helps over 1 million people per month to plan their perfect cruise holidays.

I would question a few of the interventions he paid for. If I had “jacked up my knee” or if I was seeing a doctor for my sore knee, I do not need my O2 sat taken ($32 charge…omg), I would not need blood work done either. Nor would I have had some sort of IV started, so further savings. The physical exam, the xrays and the knee bandaging would be all I would have agreed to. Hopefully I never have to visit the medical unit (but good job it is there when needed). I probably would be a difficult patient, declining unnecessary interventions. Hopefully he gets to his doctor at home and has the knee seen to.

My wife has asthma and on our Mediterranean cruise, she experienced severe breathing distress. Our final bill was $2488 which we paid before disembarking. When we filed the travel insurance claim, we were told they were secondary and that we would have to file with our personal medical insurance first. We did. After 7 months of haggling between our medical insurance and the travel insurance, we finally got reimbursement. Final analysis – when purchasing travel insurance, make sure the travel insurance is ‘primary coverage’. That way, you deal directly with them and they can’t shove you off on anyone else.

I’m so sorry that you had to go through that and thank you for the excellent advice. Jenni

Well I don’t know what the bill was, or even if it was paid but…

When we cruised on Virgin’s Resilient Lady in 2023’s Athens to Sydney relocation, we had just entered the Red Sea

We were somewhere if the coast of Eritrea and the Houthi rebels of Yemen had begun launching missiles at Israel

At around 2am the captain made an announcement that we there was to be a medical evacuation

We sailed at speed towards Djibouti and out of nowhere a US Marine Osprey and an F-16 appeared

The Osprey made at least 8 attempts to drop off a medical team and offload a passenger before disappearing into the night

The title made me think that there would a multi-thousand dollar medical bill. $812 isn’t staggering nor extraordinary. Maybe the writer has never paid a $2,000 medical bill before. What am I missing?

It seems steep for a bandage to me. For $2k I’d be wanting a new knee. But then I am British.

In the UK, the cost of a TKR (single total knee replacement) on the NHS is nil to the patient but is around £14,000 to the NHS. I’ve had both knees done, at different times, so £28,000!

My husband recently took ill on Cunard and his medical Bill was over $1,200.00

Absolutely shocking considering it was only assessment and blood tests before sending him to hospital

Kath smith

[email protected]

My husband was prescribed some tablets 2 days before we left for a cruise. We were unable to get the rather expensive item until the day before we left. During the cruise he became very ill and needed to attend the medical center onboard Iona. It was like a small hospital and able to do all sorts of tests to decide why he had been prescribed the tablets. He was having a reaction to the tablets. They asked us to contact our own doctor for a decision about what to do. Our doctor left them to decide and told us it was the only medication possible for the problem. We must have been there for tests at least 5 times and ended up with a bill over £800. Trying to claim this back took nearly 18 months. But after seeing his medical notes for the past 2 years the claim was settled. Would you risk going without insurance?

So sorry to hear that happened to you. I would never cruise without insurance. If you need a helicopter it would cost tens of thousands. Not worth the risk.

Surely if he was working on the ship, holiday insurance wouldn’t apply anyway. I admire his honesty for not lying, but sadly it’s the usual case of honesty is the best poverty!

It depends on the terms of the insurance. You can get travel insurance that also covers you if you’re working abroad.