You need cruise insurance when you travel – but you shouldn’t assume that, once you have a policy in place, you’re covered in every eventuality.

There are actually quite a lot of scenarios where you won’t be covered, or at least not by most cruise insurance policies – some have extras or might just vary.

It’s always important to read the terms – I know it’s boring, especially if you’re paying for a policy on the same day you book your cruise like you should – but you need to know what’s covered and what isn’t.

Let’s look at what you typically won’t be covered for:

1. Injuries while intoxicated

If you have a drink package, you’re probably going to spend most of your cruise technically intoxicated. If you don’t, you’re probably not getting your money’s worth.

And you don’t need to be roaring drunk and doing silly things for your insurance not to pay out.

I recently took a cruise with a friend who ended up in the medical centre at midnight. A rather large, drunk person stumbled backwards into her and stamped on her foot, ripping off her toenail and causing quite a bloodbath, before quickly fleeing the scene without so much as an apology.

As she was in so much pain, I filled out the paperwork for her, and one of the questions was about how many alcoholic drinks she had consumed that day.

The accident wasn’t her fault at all, but I’m sure that if she had needed to claim on her insurance, they wouldn’t have paid out. Luckily, the ship kindly waived any fees.

2. Missing the ship

Whether it’s embarkation day for your cruise, or you’ve been off exploring a port on an exciting adventure, there’s one thing you always have to remember – it is your responsibility to make sure you are on the ship before she sails away.

It doesn’t matter if there was traffic that delayed you getting to the port, or if you booked a proper excursion.

If you aren’t onboard at departure time, the ship is going to sail away without you. And your insurer won’t do a thing to compensate you for it, even if it means your entire cruise is over before it started, or you end up stranded on an African island.

Missing the ship – especially in a random destination – is one of the worst things that could happen to you and you’ll have to arrange your own travel home. So just make sure you don’t.

3. Some cancelled cruises

Generally, you’ll be covered for the cost of your cruise if it’s cancelled either by the cruise line, or by your insurer. It’s not your fault if a cruise is cancelled, and you shouldn’t have to pay for it.

But…

There are some circumstances where a cruise could be cancelled and you could be left out of pocket. Not for the cruise fare itself, usually, but for parts of it.

For example if you book an inaugural cruise on a brand new ship, and the cruise line decides it’s not ready, then the cruise line will typically refund your cruise fare, but your insurer might not give you money back on your flights or other costs to get there.

Or if you book the cruise and flights separately, your insurer might not pay out in full:

And if your cruise line goes bust, but you’ve only booked with them a few weeks prior, some insurers would refuse to pay out on that. Some will have a clause in their contract where you need to have your booking for a set period of time to cover for a cruise line business failing.

If you stick to the big cruise lines, that shouldn’t be a concern.

4. Cruises bought with points or Future Cruise Credit

Not all cruises are paid for with money. Sometimes you might earn a significant number of rewards points, perhaps through a cruise line’s casino offers or with some other rewards scheme. In the UK, the Tesco Clubcard is a great example.

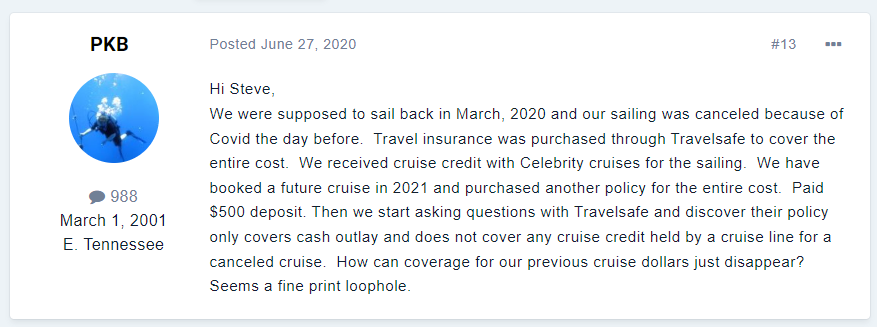

Or you might have earned Future Cruise Credit, maybe due to a past cruise being cancelled, and then applied that to a new cruise.

If you then have to cancel those cruises because you can no longer sail on them, in most cases that’s goodbye points. And your insurer has got no interest in paying you cash for the loss, nor can it help you get your points or credit back.

Your best bet is to appeal to the cruise line, but if the cancellation is your fault, you might just be out of luck.

5. Death of pets

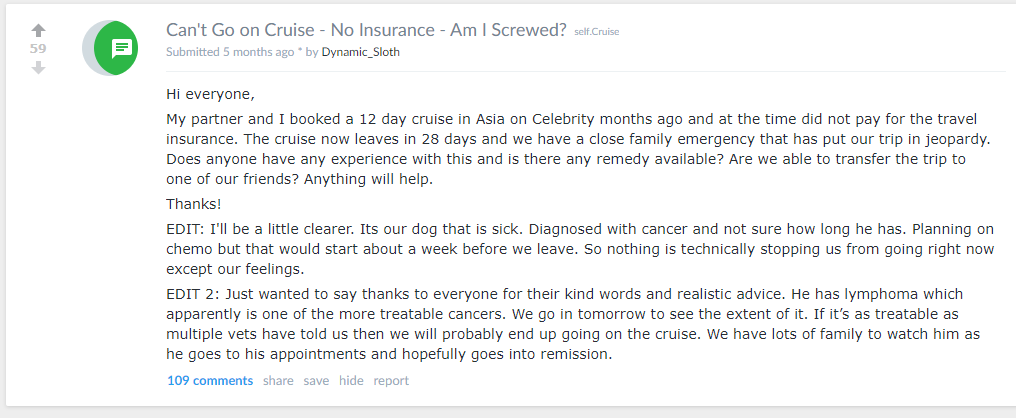

Cruise travel insurance policies will cover a lot of different scenarios for you cancelling a cruise. It’s not just if you are unable to travel – say you were to get sick – but you’ll also usually be covered for the sickness or death of a loved one, who you need to stay home and care for.

As long as that loved one is a human, anyway.

Cruise insurers won’t typically pay out if your dog or cat (or whatever animal you own) becomes ill, even if it’s terminal. If you want to cancel the cruise, then the cost will be on your head.

This person assumed that they were screwed because they hadn’t bought insurance, but they likely would’ve been even if they had…

6. Turmoil in port

Insurance companies don’t like nuance. They like facts and clear rules. This may impact you if your cruise is sailing to a destination where there’s a bit of unrest.

There are times when a cruise will determine a destination to be safe, but you aren’t too sure. You don’t want to take any risks, so you decide to stay onboard for the day.

However, because that’s your own choice, and you’re ignoring the official guidance that the port is safe, you aren’t able to claim for missed port cover. Because the port wasn’t missed – you just chose not to go ashore.

Even if you have a really solid reason, that you are genuinely worried about rising crime in a location, that’s on you and you can either go ashore or stay on the ship, but your insurance is not going to pay out.

7. Ignoring warnings about destinations

This one is the exact opposite of the point above.

Generally, cruise lines like to keep you safe and avoid risk. But there might be times where a destination suffers from some problems – political unrest or rising crime – but your government is a little slow to react and doesn’t put out a travel warning immediately, or they do but they only advise against visiting, they don’t tell you outright not to go.

If that happens, but your cruise ship still visits the port and you go ashore, and then something happens to you, your insurer might refuse to pay out because, in their eyes, you’ve been told it wasn’t safe.

So, you can’t win if you’re too careful, and you can’t win if you “ignore official travel advice” and take a risk…

8. Dental treatments

If you’re on a cruise and you trip on some stairs, spraining your ankle, you can go get it fixed up at the medical centre, get some painkillers, and your insurance will cover it.

Cut yourself on a broken glass? Insurance will cover it.

But a tooth infection that causes you agonising pain? Or you chip a tooth while eating? You might be out of luck.

Cruise insurers love to make sure that dental treatments are written out of your policy. If it’s something minor, and it doesn’t hurt, you’re best waiting until you get home and visiting your regular dentist.

If it’s an emergency – and infections definitely can be – then you may need to get treatment onboard and pay yourself, if your insurer refuses.

9. Spa treatments gone wrong

If you decide to treat yourself at the spa on your cruise ship, very little can usually go wrong – except maybe for a pushy member of the team who tries to get you to pay for oils and creams that you really don’t need, just because they’re on commission.

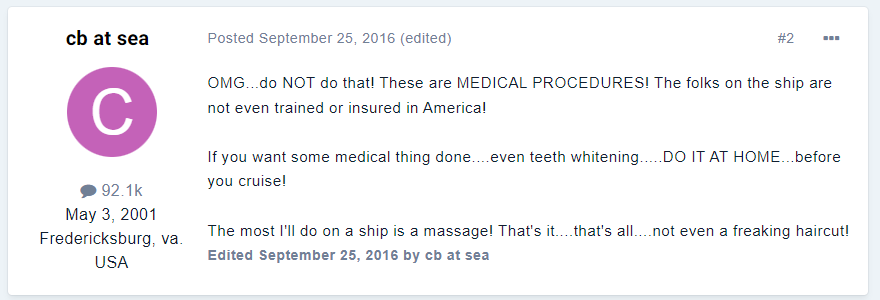

You’ll probably be fine if you stick to the massages, but if you choose a beauty treatment that is invasive, and something goes wrong, you might be stuck with the bill.

Some cruise line spas will offer botox injections and lip fillers. But, these would be classed by your insurer as medical tourism – They’ll say it’s on you since you should’ve got the work done by a doctor on land, in your own country where you’re covered medically already.

These treatments can easily go awry, so don’t risk it, especially if you’re not prepared to pay for the work to be fixed once you get home out of your own pocket.

10. Any undeclared conditions

This one is pretty obvious, but it’s still important to mention.

If you have a pre-existing medical condition and you don’t declare it when you buy your insurance policy, there is almost zero chance that the insurer will pay out for medical treatments related to that condition.

And if they find out you’ve got a condition, and then something else goes wrong, don’t be surprised if they try to find a link between them.

Insurers don’t want to pay out. They want to make money. And if they can make a case that you’re at fault because you’ve bought an invalid policy, based on non-disclosure of medical conditions, then they absolutely will do. Don’t risk it.

11. Theft of unattended items onboard

A minor issue that you will hopefully never have to deal with, but one that’s worth mentioning.

If you’re a victim of theft while you’re on a cruise, you should normally be able to make a claim through your insurance to cover the cost of the stolen items

But if the insurer finds out that you’ve been negligent, then they might refuse.

Anything stolen from your cabin should be covered, since those doors lock automatically. But if you take your designer sunglasses to the pool, put them down next to you and forget while you nip to the bar, and someone takes them, it might be tough luck.

For smaller items you probably won’t get too much of a grilling from the insurer, but if it’s something really valuable that would normally be covered, the insurer might ask for a ship’s report where you’d have to be honest about leaving it unattended, and then the insurer might say no.

Also, be aware that some insurers will ask you to claim for some items through your home insurance before claiming through them for certain items like laptops – they might cover you, but only if your home insurance doesn’t.

12. More extreme shore excursions

While your cruise insurance will cover you in the case of most accidents or emergencies while you’re at sea or in port, there are some activities that will fall outside your policy.

Those tend to be the more extreme shore excursions where you’re at higher risk of hurting yourself, such as river rafting, or diving with sharks.

If you don’t want to miss out on these experiences, but you also don’t want to be liable for costs if something goes very wrong, ask for specialist cover for these types of activities if they aren’t included as standard. You should be able to get extra cover, though you’ll have to pay more.

13. Changing Your Mind

Finally, some people assume that cruise insurance lets you cancel your cruise for any reason and get your money back, including just changing your mind about wanting to go.

That can be true, if you’ve specifically bought a policy that includes “cancel for any reason” cover. But you need to make sure that’s what you’ve got, as most policies will only have a limited list of acceptable reasons for cancelling if you want a pay out, and changing your mind isn’t one of them.

Your cruise line might refund you anyway, if you’re cancelling far in advance of your sail date, but if it’s close to departure and you don’t have cover which lets you cancel for any reason, you might not be able to claim any money back unfortunately.

My Recommendation

My recommendation for cruise insurance depends on where you live.

- If you live the UK: Compare Your Cruise Insurance

- If you live the USA: InsureMyTrip

These are trusted price comparison sites that will quickly get you lots of quotes to match your exact needs.

Final Word

Did any of these surprise you? Some of them make sense, but there are others where it could definitely be harsh of the insurer to not pay out. That’s what they do though.

The good thing is that they will typically pay for the most important things – cruises cancelled outside of your control, and medical expenses while you’re at sea.

Read my buying guide for cruise insurance if you want to know the basics, including what to expect cost-wise.

And when you’re ready to buy, I’d always recommend using a price comparison site like Compare Your Cruise Insurance (UK) or InsureMyTrip (USA) so that you can easily check a range of policy providers, and get the best price.

Related Topics

- 8 Horror Stories From Cruisers Who Had No Insurance

- 9 Reasons Cruise Insurance Is So Expensive

- 7 Things You Need To Know Before Buying Cruise Insurance

Jenni Fielding is the founder of Cruise Mummy. She has worked in the cruise industry since 2015 and has taken over 30 cruises. Now, she helps over 1 million people per month to plan their perfect cruise holidays.

Does Medicare cover medical expenses on ship while in US water

Usually no because cruise ship doctors are not usually registered in the US.Insurance is recommended.

Can you explain insurance that is provided through the credit card that was used to purchase the cruise. How does it measure to insurance from other private cruise insurance companies?